Everything you need to know about Minor PAN Cards in India — from eligibility and documents to how to apply online or offline, and steps to update after 18. By CA Bhavesh Panpaliya.

1. What exactly is a Minor PAN Card – and can a child really have one?

Absolutely!

A Minor PAN Card is a special version of the Permanent Account Number (PAN) card issued to individuals below the age of 18. While it’s commonly assumed that PAN is just for working adults, the Income Tax Department imposes no age bar.

🧾 Example: Riya, age 12, wants to open a Sukanya Samriddhi Yojana account. For this, she’ll need a PAN – even though she’s not earning yet!

Sukanya Samriddhi Yojana Benefit🔗 Sukanya Samriddhi Yojana – India Posthttps://www.indiapost.gov.in/Financial/Pages/Content/Sukanya-Samriddhi-Account.aspx

🔗 Sukanya Samriddhi Scheme – National Savings Institutehttps://www.nsiindia.gov.in/InternalPage.aspx?Id_Pk=89

2. Why would a minor need a PAN Card if they don’t pay taxes?

Good question! Here’s why a minor might need a PAN:

• To be made a nominee in investments (like mutual funds, stocks)

• For opening bank accounts (e.g., Sukanya Samriddhi or PPF)

• For investments made in the child’s name

• If the minor earns income via acting, social media, YouTube, or even tuition – it’s not clubbed with parents’ income in some cases!

💡 Key Insight: A minor’s income is taxable separately if it’s earned from their own talent or disability benefits.

3. How can one apply for a Minor PAN Card?

Minors can’t apply on their own – but their parent or legal guardian can apply on their behalf.

There are two ways:

🔹 Online via NSDL portal:

• Choose Form 49A → Individual → Minor’s details

• Upload relevant docs + pay fees

• Submit digitally or send physical copies

🔹 Offline:

• Download and fill Form 49A

• Paste 2 passport photos of the minor

• Submit documents & fees at a PAN Centre

💡 Pro Tip: Use the parent’s Aadhaar for identity/address proof, and the child’s birth certificate as DoB proof. https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

4. What documents are required for a Minor PAN?

Here’s a quick checklist ✅:

📌 Proof of Identity (POI) – Parent or Guardian’s

• Aadhaar / Passport / Voter ID / DL / Govt. ID

📌 Proof of Address (POA) – Parent or Guardian’s

• Same as above + Utility Bill / Bank Statement

📌 Proof of Date of Birth – Minor’s own

• Birth Certificate / Aadhaar / Passport / School Record

👶 Tip: If the minor has Aadhaar, it can serve as all-in-one document!

5. Wait… there’s no photo or signature on a Minor PAN?

Correct. Since minors cannot legally sign, and photos change with age, the Minor PAN is issued without a photo or signature.

🧾 So, while the PAN exists for financial tracking, it’s not a standalone ID proof until updated after age 18.

6. What happens when the minor turns 18?

🎉 Happy Birthday… Now Update Your PAN!

Once a person becomes a major (18+ years), they must update their PAN card details – especially photo and signature.

⚠️ Why? Because without these updates, the card is invalid for official use as an adult.

7. How to update a Minor PAN to a Major PAN after turning 18?

Simple. Visit the NSDL website and choose:

“Changes or Corrections in Existing PAN”

Here’s what to do:

• Enter your existing PAN details

• Tick ✔ “Photo Mismatch” and “Signature Mismatch”

• Upload new photo, signature, ID & address proof

• Make payment and track via acknowledgment number

🖊️ Example: Aditya turns 18. His new PAN now includes his grown-up photo, signature, and his own Aadhaar as ID proof.

https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

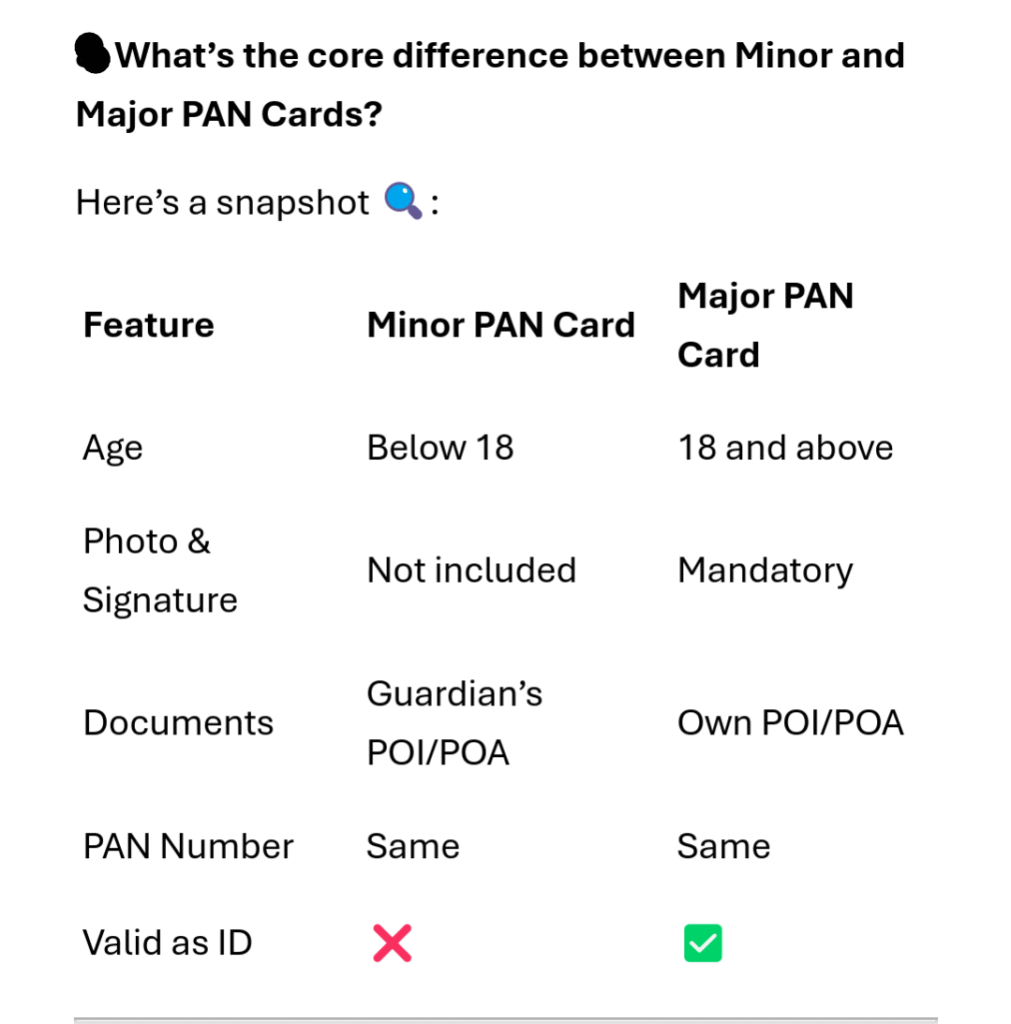

8. What’s the core difference between Minor and Major PAN Cards?

Here’s a snapshot 🔍:

Final Thoughts:

A Minor PAN Card is more than a formality – it’s a gateway to financial inclusion, early investment, and smooth banking access. But don’t forget to update it after 18 for full identity and tax compliance benefits!

💡 Need help applying for a Minor PAN or updating after 18?

📞 Call/WhatsApp: CA Bhavesh +91 8888755557

📧 Email: bpanpaliya@gmail.com

🌐 Visit: cabhaveshpanpaliya.com